Crowdfunding Explained

In May, we announced that Duration would be launching its first and likely only equity-based crowdfund raise. We then set off on a two week roadtrip to tell you more about it. In June, launched with a bang reaching our initial target raise in little over a week. We now working to hit our stretch goals before the campaign #ForTheDuration ends on Friday 17th June.

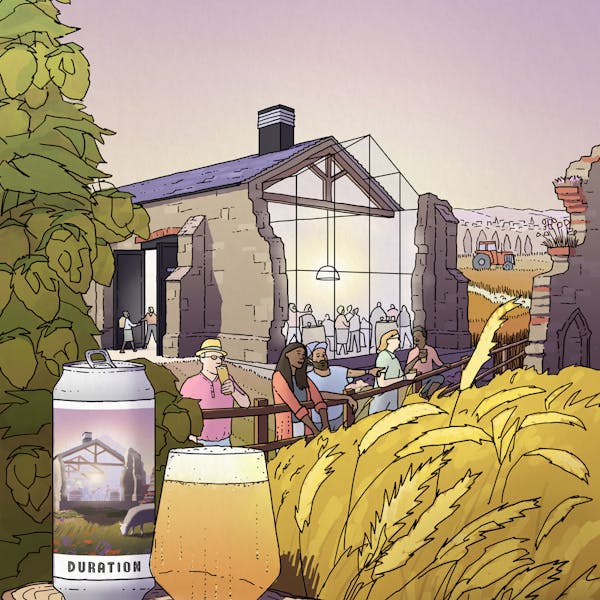

We’re crowdfunding as we’d like to treble our production capacity, invest in new equipment and build an immersive on-site taproom to invite drinkers to the heart of our brewery.

We’d also like to add to our sustainability by increasing our water treatment plant, adding rainwater recapture to our roofs and by planting a fruit orchard on our farm.

If you’re new to crowdfunding, please keep reading to learn the main points of what it’s all about.

WHAT IS EQUITY CROWDFUNDING?

Crowdfunding is where a company raises small amounts of money from a large number of individual investors rather than accepting a large sum of money from an investment fund or venture capitalist. These investors get to help companies that they like grow and also see a return on their money through equity shares.

A shareholder has partial ownership of a company and stands to profit in dividends should the company continue to perform well and increase in value and see profits.

Our crowdfund is equity based but in addition we are also offering some perks and rewards including an invitation to the new taproom launch and brew days and lifetime discounts on beer in store and online.

WHY IS DURATION BREWING CROWDFUNDING?

We’re crowdfunding as we’d like to treble our production capacity, invest in new equipment and build an immersive on-site taproom to invite drinkers to the heart of our brewery.

We’d also like to add to our sustainability by increasing our water treatment plant, adding rainwater recapture to our roofs and by planting a fruit orchard on our farm.

HOW DO I INVEST?

We’ve partnered with Crowdcube to manage our raise. Crowdcube is a crowdfunding platform that enables start-ups and scale-ups to issue shares and raise money from a wide range of every day and experienced investors who want to share in the future of companies they believe in.

To invest, you’ll need to have a Crowdcube account set up. We’d recommend doing this immediately. You will just need to provide some details like your email, a bank card for payment (when the campaign closes) and you’ll be asked to answer to brief ‘Invest Aware’ survey to ensure you understands the risks on your capital.

HOW MUCH ARE SHARES?

A share costs £5.47 and we have had some investors pledge £5k or £10k and some £50 or £500!

WHEN WILL THE CAMPAIGN GO LIVE?

We are already live! In fact, our crowdfunding campaign will end soon. This means you can invest immediately. To do so please visit www.crowdcube.com/durationbrewing

WHEN CAN I EXPECT TO SEE DIVIDENDS?

We have made projections for the company to both execute the work and increase operations and expect to be paying dividends by year ending April 2026. We will keep everyone informed of our progress via a report from our annual general meeting AGM.

CAN I SELL OR TRANSFER MY SHARES?

You can express your interest in selling your shares in a company via Cubex, which enables you to discover, research, and express an interest in buying or selling shares in private European companies. If enough interest is expressed in a given business, Crowdcube will seek to facilitate a transaction, and you will be notified when a sale goes live.

WHAT HAPPENS AFTER I INVEST?

Once the pitch reaches its target and closes to further funding, the completion process starts. At that point, all investors will receive a copy of the Articles of Association via email and will be informed of the cooling-off period.

Once the cooling-off period, which is generally no less than seven days, has expired, the payment collections process starts and then electronic share certificates are issued.